(Bloomberg) — Washington’s heated debate over whether President Joe Biden will drop his re-election bid is spilling over to Wall Street, where traders are moving money in and out of the dollar (DX=F), Treasuries and other assets that would be affected by Donald Trump’s return to office.

Most Read by Bloomberg

The recalibration of portfolios began late last week after Biden’s disastrous debate with Trump raised concerns that the 81-year-old Democrat is too old to serve another term. Trading action was then sharpest in the bond market, where yields on the 10-year Treasury jumped as much as 20 basis points over the next few days.

With speculation now growing rapidly that Biden could drop out of the race — betting markets see less than a 50% chance he will remain the candidate — investors are scrambling to make contingency plans to react to such an announcement during the holiday season. Fourth of July Thursday and the following weekend. .

One fund manager, speaking on condition of anonymity given the sensitivity of the topic, said he was heading into the break biased against the dollar and short-term debt as he hedged against rising risk he thought would be driven by a pullback in Biden. No president has chosen to seek a second term since Lyndon Johnson in 1968, and the election is just four months away.

“Markets have already reassessed the election odds since the debate, so the news of the last 24 hours has only added fuel to the fire,” said Gennadiy Goldberg, head of US rates strategy at TD Securities in New York.

The consensus among traders and strategists is that the re-election of Trump, a 78-year-old Republican, would boost trades that benefit from an inflationary mix of looser fiscal policy and greater protectionism: A strong dollar, higher bond yields US and gains in banking, health and energy stocks.

Even some 10,000 miles away, in Sydney, they are preparing. Rodrigo Catril, a strategist at National Australia Bank, said “everyone” is preparing trading plans in case Biden ends his campaign.

“Either way, the market is betting that Trump will win the election,” Catril said. “It seems the Democrats are stuck with very difficult choices, none of them easy and none of them likely to produce a better outcome.”

Here’s how Trump’s so-called trade is materializing in the markets:

Dollar sign

The dollar (DXY) gave one of the earliest signals of how markets would adjust to a possible Trump victory, gaining in the hours after last week’s debate. While the greenback has received a boost this year from indications by the Federal Reserve that it intends to keep interest rates higher for longer, the currency got a clear boost in real time after Trump dominated the showdown with Biden.

Trump has decided to cut taxes and impose 60% tariffs on imports from China and 10% tariffs on those from the rest of the world. The chief economist of Goldman Sachs Group Inc. Jan Hatzius said this week that such taxes could increase inflation and force the Fed to raise rates about five times more than otherwise.

“A Trump victory raises the possibility of higher inflation and a stronger dollar, given his promise of more tariffs and a tougher stance on immigration,” JPMorgan Chase & Co. strategists said. led by Joyce Chang.

Potential losers against a rising dollar and Trump’s expected support for tariffs include the Mexican peso (MXN=X) and the Chinese yuan (CNY=X).

Yield curve trading

After the debate, money managers in the $27 trillion Treasury market reacted by buying shorter-maturity notes and selling longer-dated ones — a bet known as a faster trade.

A host of Wall Street strategists have defended the strategy, including Morgan Stanley and Barclays Plc, urging clients to brace for sustained inflation and higher long-term yields in another Trump term.

In a two-day span starting late last week, 10-year yields rose about 13 basis points over 2-year rates, in the curve’s steepest slope since October.

Signs of traders bracing for short-term volatility in the Treasury market emerged on Wednesday through a buyer of a so-called strangle structure, which takes advantage of a future move higher or lower through strike prices. Along with potential risk over the holiday weekend surrounding Biden’s candidacy, the expiration also includes Friday’s U.S. jobs data and testimony next week from Fed Chairman Jerome Powell.

Profit of stocks

The prospect of a Trump victory has buoyed a host of stocks that could benefit from his perceived stances on the regulatory environment, mergers and trade relations. The broader market has powered higher in the wake of the debate.

The turn in the electoral tide since last week “has meant higher stakes as Republicans are generally seen as more business-friendly,” said Tom Essaye, president and founder of the Sevens Report.

Health insurers UnitedHealth Group Inc. (UNH) and Humana Inc. (HUM) and banks will benefit from the looser regulations. Discover Financial Services (DFS) and Capital One Financial Corp. ( COF ) are among the credit card companies that have grown bullish on Trump, given the duo’s pending deal and speculation about potential changes to late fee rules.

Energy stocks like Occidental Petroleum Corp. (OXY) rose after the debate, as the former president is seen as having a pro-oil stance. Private prison stocks like GEO Group Inc. (GEO) have reacted to his tough views on immigration.

Financial ETFs

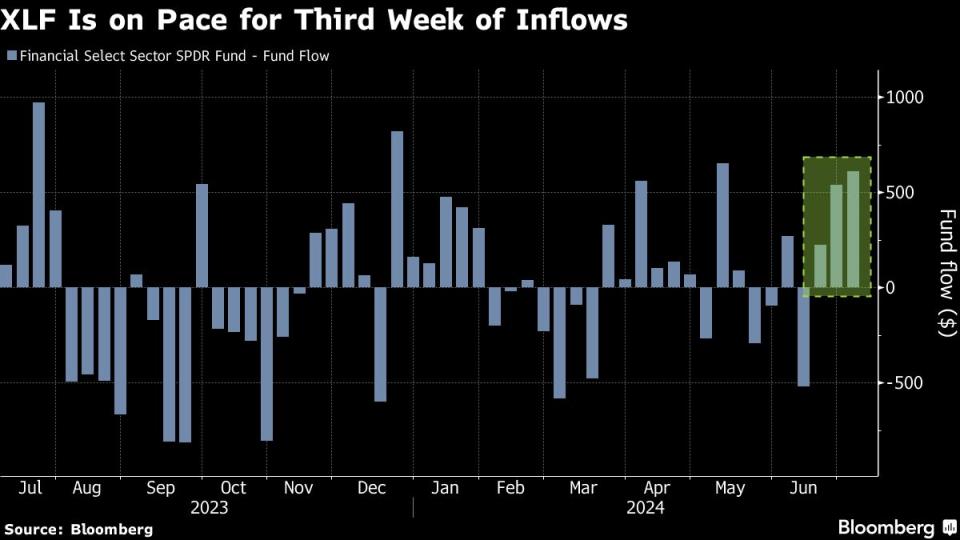

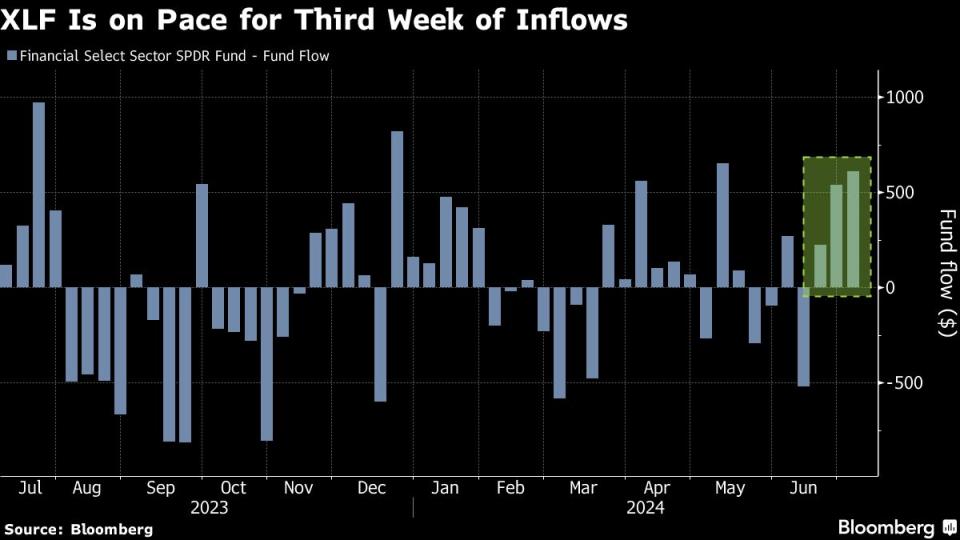

The exchange-traded fund market has shown a clear investment strategy lately: Long banks on bets that Trump will push for deregulation and a steeper Treasury curve thanks to his potentially inflationary agenda.

The Financial Select Sector SPDR Fund (ticker XLF), a $40 billion fund, last week saw its biggest inflows in more than two months, with investors adding roughly $540 million. So far this week, they’ve added $611 million amid recent gyrations in the interest rate market.

Meanwhile, a thematic investment strategy designed to capture the Trump trade has struggled to gain traction. An ETF that plays the attractive MAGA stock and invests in Republican-friendly stocks has been slow to accumulate assets and has seen no material inflows this year, data compiled by Bloomberg show.

Asian influence

Asian markets are not immune to speculation either, with US-China tensions simmering and tariffs in play.

“Mr Trump’s re-election should be a negative factor for China stocks as Mr Trump supports the idea of imposing much higher tariffs on US imports from China,” said Tomo Kinoshita, global market strategist at Invesco Asset Management Japan. “In that regard, Japanese stocks with high exposure to the Chinese market are likely to suffer if Mr. Trump wins.”

Crypto support

Trump has shown support for the crypto industry in recent weeks by meeting with industry leaders and promising to ensure that all future Bitcoin mining takes place in the US.

That makes the Solana token (SOL-USD) — the fifth-largest cryptocurrency with a market capitalization of about $67 billion, according to CoinMarketCap — a potential beneficiary of Trump’s return to the White House. Asset managers VanEck and 21Shares have filed for ETFs that would invest directly in digital currency.

While many see approval as a long shot, the thinking among some market participants is that a newly elected Trump will appoint a chairman of the Securities and Exchange Commission who is more crypto-friendly than Gary Gensler has been under Biden. That’s an outcome that would make a Solana ETF — and a corresponding rally in the token — more likely.

According to Stephane Ouellette, chief executive of FRNT Financial, the prospect of a change in the Democratic ticket is also likely to boost Bitcoin.

“The crazier the US political system looks, the better Bitcoin looks,” Ouellette said “That’s the kind of atmosphere Bitcoin would go to. The craziness in the US political system is a pro-Bitcoin factor.”

—With assistance from Emily Nicolle, Katie Greifeld, Edward Bolingbroke, Anya Andrianova, Jan-Patrick Barnert, Natalia Kniazhevich, Ruth Carson, Bre Bradham, Nazmul Ahasan, Winnie Hsu, Carter Johnson, Vildana Hajric, Liz Capo Ye XCormick.

Most Read by Bloomberg Businessweek

©2024 Bloomberg LP