- An analyst predicted a significant increase in the price of Bitcoin.

- Recent market indicators suggested an imminent bullish move.

Despite a recent downtrend in Bitcoin [BTC] price, falling to $60,790 after a brief peak above $63,000 earlier in the week, the market may be on the verge of a significant rally.

The previous day’s 2.8% decline has not stopped market analysts from predicting an imminent rise.

In fact, well-known crypto analyst Lark Davis is at the forefront, suggesting that Bitcoin could be getting ready for a dramatic increase in value over the coming weeks.

A road to the rally

Lark Davis, a well-known figure in the crypto community, has expressed optimism about the near future of Bitcoin, influenced by a wave of institutional investments ready to enter the market.

Davis aligned his predictions with Standard Chartered Bank’s projection for Bitcoin to potentially hit $100,000 by August.

Although, he adjusted expectations to a more conservative $90,000 by the end of this year.

Davis also found that the anticipated inflow of institutional money through Bitcoin exchange-traded funds (ETFs) could offset any potential selling from significant Bitcoin issuances or government purchases.

Davis highlights the need for Bitcoin to first break the $72,000 resistance level, which could catalyze a fourth-quarter rally.

That growth, he posited, could extend beyond Bitcoin, amplifying gains across the altcoin market.

Beyond Bitcoin, Davis extended his bullish outlook for Ethereum [ETH] and some altcoins.

He predicted a significant inflow of capital into Ethereum, especially from future ETFs, which could significantly increase its price.

His enthusiasm doesn’t stop with Ethereum; Davis also highlighted Solana’s potential [SOL]which he saw as a leader in blockchain development and market momentum.

Exploring the crypto ecosystem further, Davis expressed confidence in Polkadot [DOT]Helium [HNT]and even lesser-followed projects like Arweave [AR] and Fetch.ai [ASA].

Each of these platforms offers unique solutions and innovations that could play important roles in the growth of the broader crypto market, according to the analyst.

Is Bitcoin ready for growth?

While Davis predicted a significant rally for Bitcoin in the coming weeks, a closer look at Bitcoin’s fundamentals was essential to gauge the asset’s readiness for such a bullish outcome.

Glassnode’s AMBCrypto Analysis data revealed a surge in new BTC addresses, with numbers jumping from under 250,000 in early June to a peak of 432,000 on July 1.

Source: Glassnode

Ali, a well-known crypto analyst, supported this perspective, pointing out that the old adage “Sell in May and run” no longer works, as retail investors make a strong return, hitting a four-month high in new BTC addresses.

Source: Ali in X

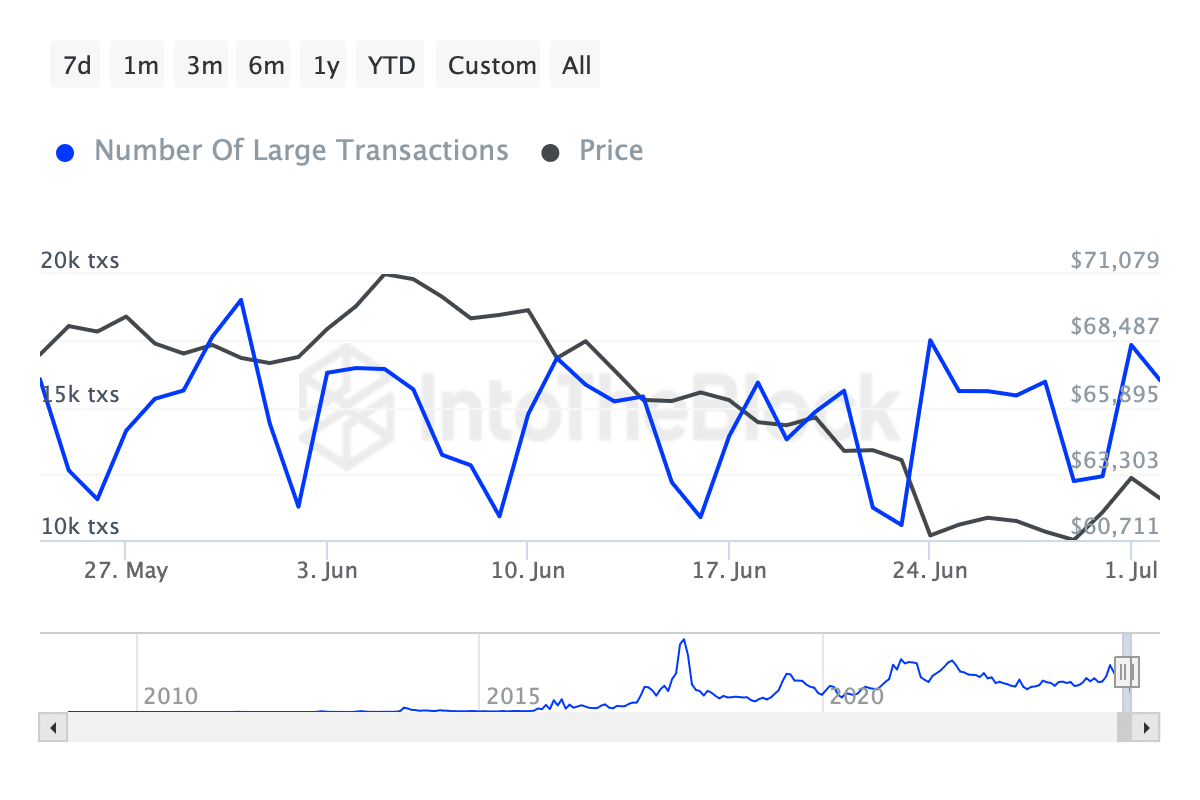

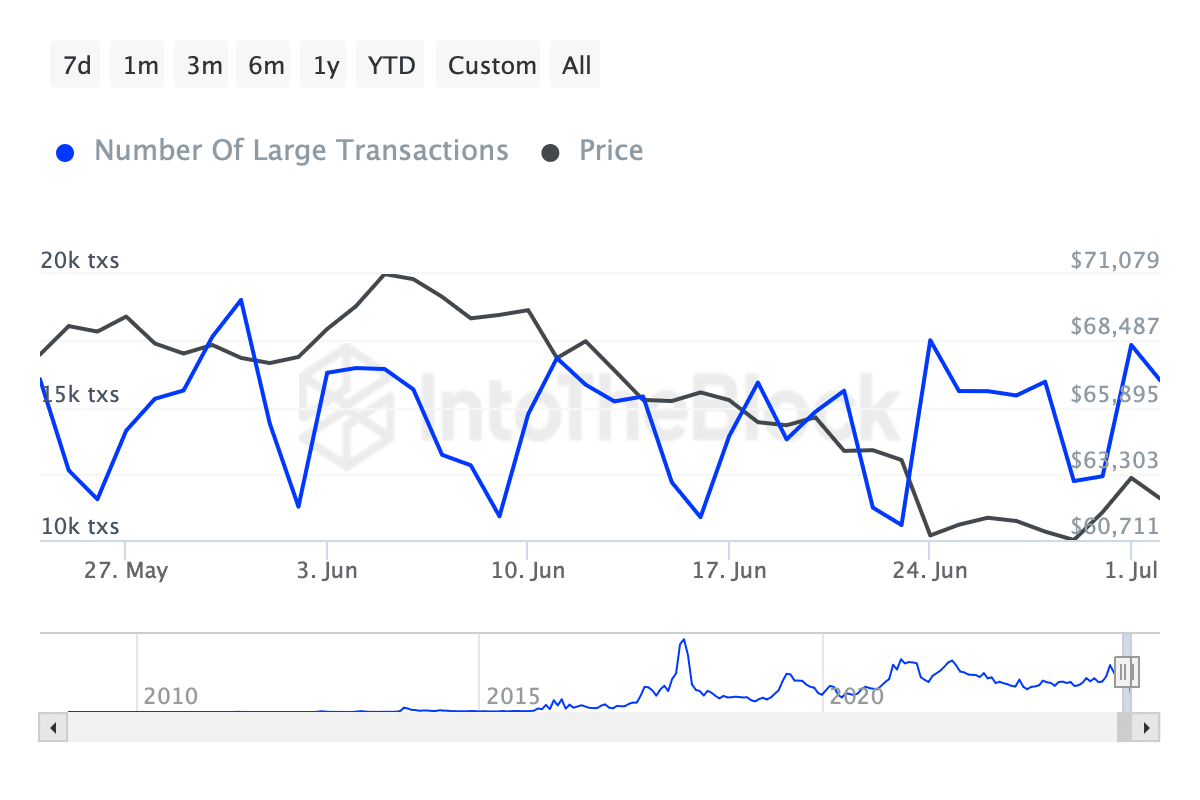

The trend was mirrored by a growing interest among Bitcoin whales.

Overview of AMABCrypto data from IntoTheBlock showed that Bitcoin transactions exceeding $100,000 have increased from less than 12,000 transactions in early June to over 17,000 by July 1.

Read Bitcoin [BTC] Price Forecast 2024-25

This indicates increased market activity and potential accumulation by large-scale investors.

Source: IntoTheBlock

In contrast, AMBCrypto reported a noticeable drop in Bitcoin’s hash rate in recent days, potentially signaling an upcoming phase of miner capitulation.